If you’re looking for a product that offers death benefit protection and the opportunity to build long-term cash value accumulation, an Indexed Universal Life (IUL) may fit your needs. An IUL policy will provide security today with the cash value growth potential you need for tomorrow.

|

Key benefits

|

Why is this important?

|

Premium flexibility | The ability to increase or decrease premiums in the future to accommodate your budget or cash flow needs. |

Death benefit flexibility | IUL life insurance policies allow you to customize the policy’s death benefit to meet your current or anticipated needs. |

Builds cash value | Cash value life insurance provides financial flexibility. Because cash values have the potential to grow inside the IUL policy, you may be able to access the cash value while you are living. |

Tax advantages | The growth of cash value within the IUL policy is generally tax-free, meaning it grows without being subject to annual income taxes. This allows the cash value to grow at a faster rate over time. |

Favorable loan feature | If your IUL policy has adequate cash value, you can borrow against it with flexible repayment terms and low interest rates. |

Customizable | The option to design an IUL policy that reflects your particular needs and situation. |

With an indexed universal life policy, you allocate premium to an Indexed Account, thereby creating a Segment and the 12-month Segment Term for that segment begins.

Values remain in the segment for the length of the segment term. Withdrawals may occur.

At the end of the segment term, each segment earns an Indexed Credit. The Indexed Credit is calculated from the change of the S&P 500* during that one- year period and is subject to the limits declared for that segment.

An Indexed Credit is calculated for a segment if value remains in the segment at segment maturity. The amount calculated is subject to the declared limits for the specific segment.

These limits are determined at the beginning of the segment term and are guaranteed for the entire segment term.

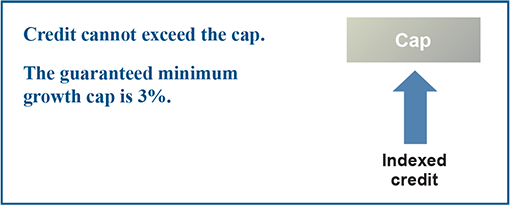

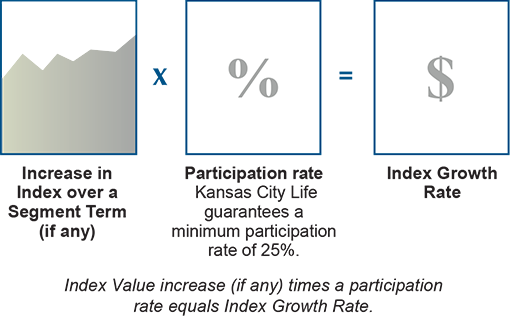

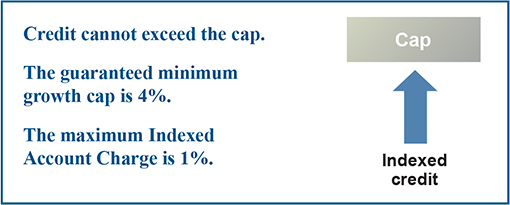

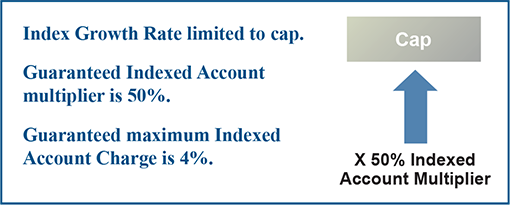

There are four choices of Indexed Accounts (Indexed Account A, B, C, and E) and each has a different type of limit. Indexed Account A sets a cap on the Indexed Credit for a segment. Indexed Account B declares the proportion of the change in the index that will determine the Indexed Credit. Indexed Account C has a higher minimum cap than A and an Indexed Account Charge. The guaranteed maximum Indexed Account Charge is 1%. Lastly, Indexed Account E determines the Indexed Credit using a cap with a guaranteed multiplier of 50%. Indexed Account E has an Indexed Account Charge with a guaranteed maximum of 4%.

Growth cap - Indexed Account A

The growth cap is the top amount Kansas City Life credits to segments in Indexed Account A. The growth cap will vary and be reset at the beginning of a segment term.

Participation rate – Indexed Account B

The participation rate determines how much of an increase in the S&P 500’s* Index Value applies to segments in Indexed Account B.

Growth cap – Indexed Account C

Higher minimum growth cap than Indexed Account A and an Indexed Account Charge.

Growth cap with Indexed Account Multiplier – Indexed Account E

Indexed Account Multiplier is applied to the increase in the Index Value limited by the cap. There is an Indexed Account Charge associated with the Indexed Account Multiplier.

Regardless of which Indexed Account you choose, your cash value is always protected from negative market performance.

Money is transferred at least once per quarter into an Indexed Account. The day on which that occurs is called a sweep date, and this creates a Segment. A Segment matures in 12 months. At Segment Maturity an Indexed Credit is calculated from the change in the S&P 500*.

The value in the Segment earns an Indexed Credit which is calculated from an Index Growth Rate. That growth rate is a percentage change in the current index from the start of a Segment until the Segment Maturity date.

The Indexed Account constraints are applied to the percentage change in the Index Value to arrive at the Index Growth Rate which is applied to the average balance in the Segment during the Segment Term provided there is money in the Segment at maturity.

Segments automatically renew for another Segment Term unless a transfer is requested. Premiums received since the last sweep date and any requested transfers are rolled into the same Segment so that for any month, there will be a single new Segment created for a given Indexed Account.